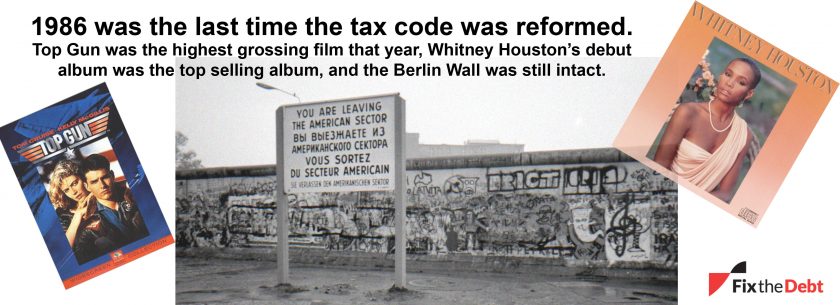

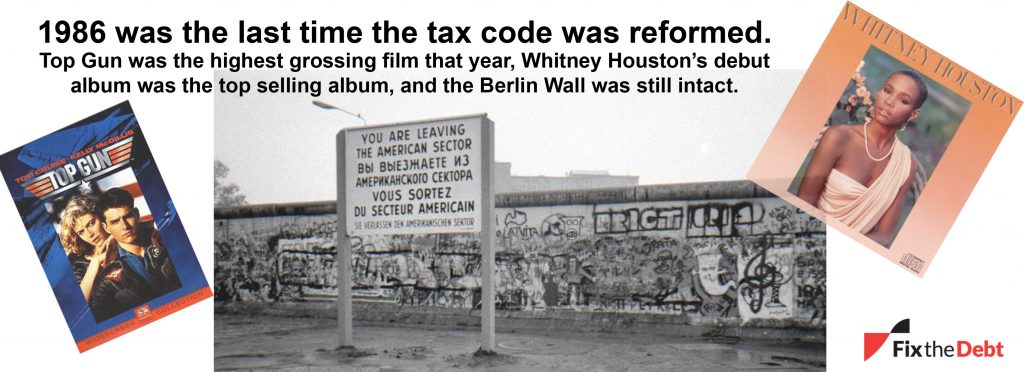

The House Republicans’ Twitter handle claimed that the U.S. has not “really reformed our tax code since 1986” in a Thursday tweet.

The House Republicans’ Twitter handle claimed that the U.S. has not “really reformed our tax code since 1986” in a Thursday tweet.

We haven’t really reformed our tax code since 1986. The year #FerrisBueller came out. https://t.co/7zPFRrgNUG pic.twitter.com/b3ZtDOlHRw

— House Republicans (@HouseGOP) September 21, 2017

The tweet linked to a marketing message describing how the tax code “hasn’t been substantially reformed since 1986,” the same year as the Ferris Bueller movie release, Chernobyl meltdown, and the Challenger Space Shuttle disaster.

Verdict: True

The last time the U.S. reformed its tax code in a significant way was in 1986. Tax rates, however, have fluctuated in the 31 years since.

Fact Check:

The last major overhaul of the U.S. tax code indeed took place in 1986 under the stewardship of the late President Ronald Reagan.

Reagan and the Republicans’ tax reform agenda manifested in House Resolution (H.R.) 3838, which was first introduced in the House of Representatives in December 1985. After a series of back-and-forth exchanges with the late Speaker Tip O’Neill and his Democratic House majority, Reagan signed H.R. 3838 – the Tax Reform Act of 1986 – into law in October 1986.

The tax reform package lowered income tax rates and eliminated many deductions while widening the tax base, thereby giving United States’ biggest taxpayers relief. Reagan’s 1986 tax reform was the last time when structural facets of the U.S. tax code – like deductions and tax base composition – were comprehensively overhauled.

The tax code as a whole, however, has not remained static since the 1986 reforms. Individual facets of the tax code have varied and changed over the years.

Tax rates, for instance, have significantly fluctuated since Reagan’s 1980 election victory.

The tax rate for the highest income bracket went from 70 percent when Reagan won the presidency in 1980 to less than half that, coming in at 28 percent in 1988. It increased again to nearly 40 percent in the early-1990s and then dropped to 35 percent in the mid-2000s. Today, the marginal income tax rate is around 40 percent again.

Deductions have similarly changed over time. The Committee For A Responsible Federal Budget reports a “deterioration” of the tax code with the enactment of numerous new deductions and loopholes over the past three decades.

These discussions aside, the House Republicans’ claim is true. The U.S. tax code was last “substantially” reformed in 1986.

(First reported by The Daily Caller) http://dailycaller.com/2017/09/22/fact-check-was-the-last-time-the-us-significantly-reformed-the-tax-code-in-1986/ (September 22, 2017)

Want more BFT? Leave us a voicemail on our page or follow us on Twitter @BFT_Podcast and Facebook @BluntForceTruthPodcast. We want to hear from you! There’s no better place to get the #BluntForceTruth.