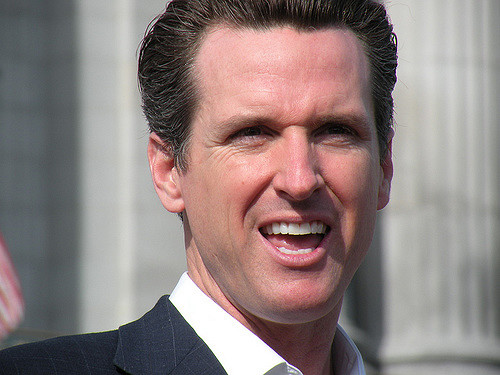

California’s Gov. Gavin Newsom missed the budget in his first month in office by $1.81 billion on a $2.53-billion crash in personal income tax collections.

Despite the State of California tax collection in December missing budget by $4.82 billion, newly inaugurated Gov. Newsom proposed a record $144.2-billion spending plan for the 2019-2020 budget on January 9 that included spending another $5.2 billion for “Cradle-to-Career” education, $1 billion for an earned income tax credit for the poor, and $100 million for refugees fleeing Central America violence.

California officials at the time claimed that December’s huge revenue miss was due to high-income taxpayers making 2018 payments in late 2017 to avoid the Trump Tax and Jobs Act maximum cap on state and local tax deductions of $10,000. Finance officers reassured this writer that January’s shortfall would be made up next month and that the new governor forecast another $6 billion in revenues for the 2019-2020 Fiscal Year that begins on July 1.

Read the full story from American Thinker

Want more BFT? Leave us a voicemail on our page or follow us on Twitter @BFT_Podcast and Facebook @BluntForceTruthPodcast. We want to hear from you! There’s no better place to get the #BluntForceTruth.