Democrats developed a sudden new concern with the size of budget deficits – something that failed to trouble them as Barack Obama doubled the national debt in just eight years – when President Trump’s tax cuts were first proposed. Nancy Pelosi assured us, “[T]his thing will explode the deficit.”

And the Congressional Budget Office, sticking to obviously incorrect static model thinking – i.e., that people don’t change their behavior when tax rates change – produced an estimate that the deficit would rise from $665 billion to $804 billion.

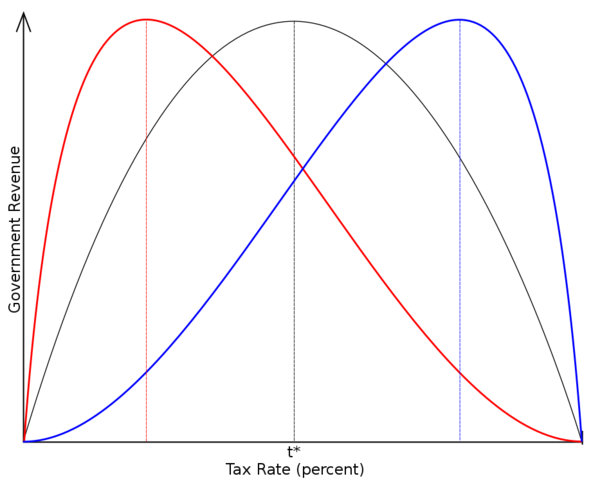

Now, data are out showing that, just as the Laffer Curve predicts, a reduction in tax rates produced such an increase on economic activity that tax revenues increased.

Investor’s Business Daily writes:

The latest monthly budget report from the nonpartisan Congressional Budget Office finds that revenues from federal income taxes were $76 billion higher in the first half of this year, compared with the first half of 2017. That’s a 9% jump, even though the lower income tax withholding schedules went into effect in February.

Read the full story from American Thinker

Want more BFT? Leave us a voicemail on our page or follow us on Twitter @BFT_Podcast and Facebook @BluntForceTruthPodcast. We want to hear from you! There’s no better place to get the #BluntForceTruth.