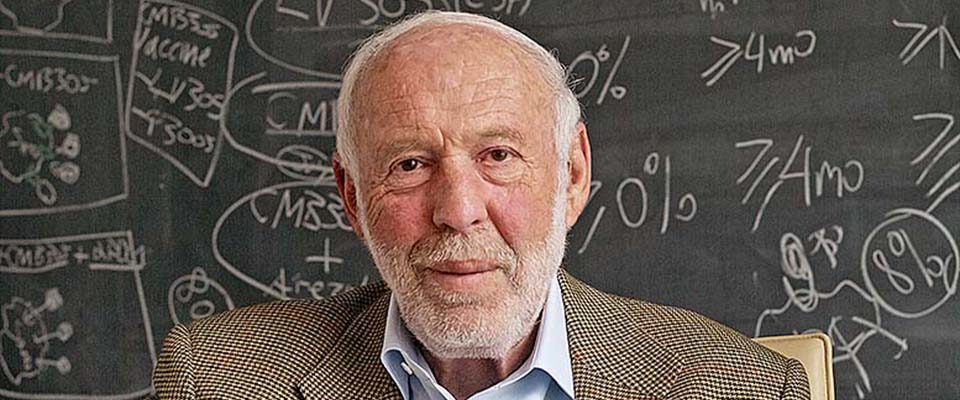

Federal regulators are probing the secret trading code at Renaissance Technologies, the massive quantitative hedge fund run by James Simons and Robert Mercer, The Post has learned.

The Commodity Futures Trading Commission has recently asked to dig into the trading software at the $65 billion hedge fund, James Rowan, the fund’s chief operating officer, told an audience of hedge fund managers on Tuesday in New York, according to two people who were in the audience.

But Renaissance, which is about as secretive as it is lucrative, is pushing back against the CFTC’s request out of fear that the code will “leak,” Rowan told the managers, according to those present.

A spokesman for Renaissance Technologies declined to comment.

Jonathan Hitchon, chief operating officer of quantitative hedge fund Two Sigma, which manages an estimated $40 billion, was also on the panel echoing Rowan’s concerns. Hitchon is on the board of the Managed Funds Association, which called out the CFTC for “overreaching in its authority” in a letter sent last month.

The pushback by Simons’ firm is the latest sign that the government is plowing into so-called “quant funds,” which use highly technical trading algorithms to try and beat the market. It is a growing area in the hedge fund space as more hedge funds, including Steve Cohen’s Point72, are increasingly hiring more developers to build algorithms.

These algorithms are often black boxes, and are so complicated that it would be nearly impossible to figure out what they’re designed to do, or why they do it.

Regulators are concerned there could be an illegal trading practice, like creating fake orders to move the prices of illiquid stocks, which is known as spoofing.

Last year, when the CFTC first outlined the regulations that would allow it to scrutinize hedge funds’ algorithms. Other major funds, like Citadel and Two Sigma, slammed the proposal, saying that sharing the code made it more likely it could fall into the wrong hands.

Even the CFTC also admitted last year that there are problems with its plan to require quant funds to share code.

“This requirement has garnered an enormous amount of attention from market participants concerned with the prospect of handing over highly valuable, proprietary business source code to an agency of the US government that has an imperfect record as a guardian of confidential information,” CFTC Commissioner Christopher Giancarlo said in September.

Renaissance is complying with the CFTC’s request for the code, and is exploring ways it can share the code in a secure setting but not have it left sitting on a CFTC file where it could be vulnerable to hacking and being leaked, Rowan said.

Trading algorithms are extremely valuable to financial firms, and Renaissance isn’t the first to go to great lengths to keep its source code secret.

In 2009, ex-Goldman Sachs programmer Sergey Aleynikov was arrested for taking the bank’s proprietary code — a charge he has twice been acquitted of, though he’s still facing charges on an appeal.

That code was Goldman’s “secret sauce,” New York District Attorney Cyrus Vance Jr. charged in 2012.

The CFTC did not respond to requests to comment.

(First reported by The New York Post) http://nypost.com/2017/06/21/regulators-probing-legendary-hedge-funds-secret-trading-code/ (June 21, 2017)

Want more BFT? Leave us a voicemail on our page or follow us on Twitter @BFT_Podcast and Facebook @BluntForceTruthPodcast. We want to hear from you! There’s no better place to get the #BluntForceTruth.

Want more BFT? Leave us a voicemail on our page or follow us on Twitter @BFT_Podcast and Facebook @BluntForceTruthPodcast. We want to hear from you! There’s no better place to get the #BluntForceTruth.