Published by The Daily Signal

Written by Rachel Greszler

The Tax Cuts and Jobs Act when signed into law will mean tax cuts for most Americans. Nevertheless, change—even good change—can bring about uncertainty.

Retirees may be the most concerned about what the new tax legislation will mean for them, as most rely on relatively fixed incomes.

But in fact, the Tax Cuts and Jobs Act is mostly good news for retirees. For the most part, they will be less affected than other Americans, as the changes do not affect the way Social Security and investment income are taxed.

Many retirees will in fact benefit from the tax bill’s doubling the size of the standard deduction.

While seniors’ earnings and pension income will be subject to new individual income tax brackets and rates, those changes will mean tax cuts—not increases—for an overwhelming majority of seniors and retirees.

There are three provisions in the new tax law that could particularly affect retirees.

- Medical Expenses Deduction

Currently, anyone who has high medical expenses can deduct the portion of those expenses that exceeds 10 percent of their income. So a couple who earns $40,000 in income and has $10,000 in medical expenses can deduct $6,000 of those expenses.

The Tax Cuts and Jobs Act increases the deductible amount to over 7.5 percent of income for 2017 and 2018. In the above example, this would mean a $7,000 deduction.

- Personal and Elderly Deductions

Currently, in addition to claiming a $4,050 personal exemption, people over 65 can also claim a $1,250 blind or elderly deduction. The Tax Cuts and Jobs Act maintains the blind and elderly deduction but eliminates the personal exemption and replaces it with a roughly doubled standard deduction.

- Other Itemized Deductions

Two of the deductions that have received the most attention are changes to state and local taxes and mortgage interest. The new tax legislation caps state and local tax deductions at $10,000.

For mortgage interest, the final legislation caps the mortgage interest deduction at $750,000, but only for new home purchases. These deductions tend to have less impact on retirees who often have no mortgage or are far enough along in their mortgage payments that they have little mortgage interest.

Retirees typically also have lower state and local income taxes because not all of their income is subject to taxation.

To illustrate just how the Tax Cuts and Jobs Act will affect different retirees, consider these five examples.

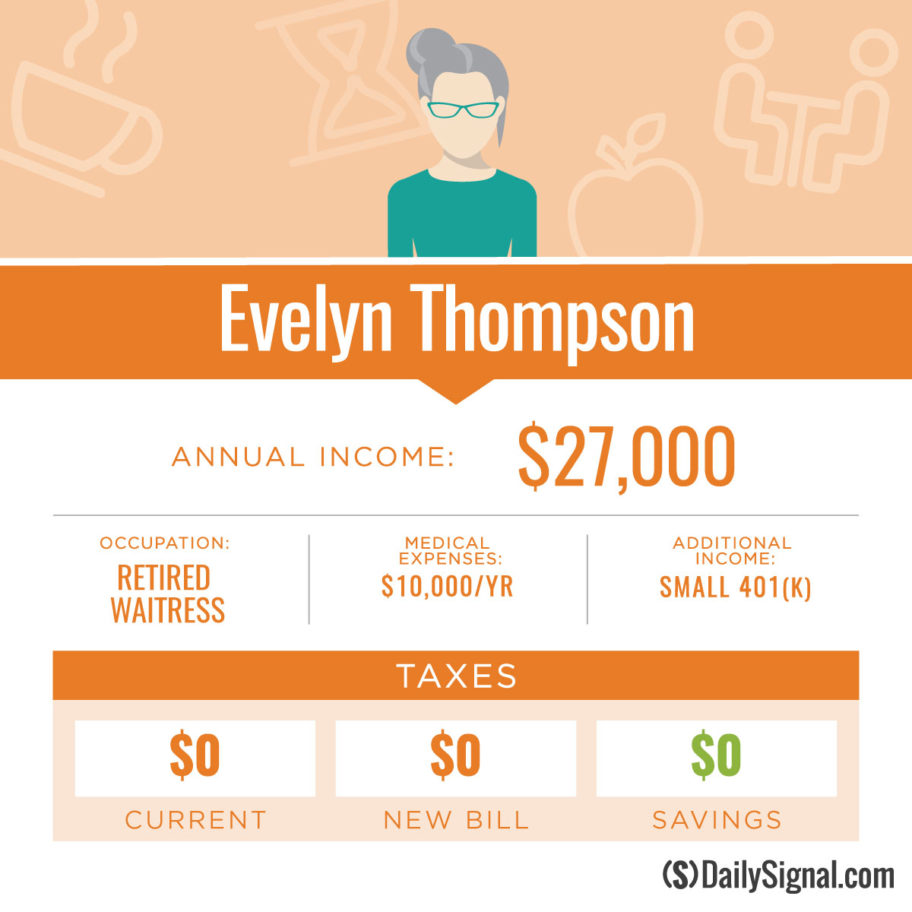

Evelyn Thompson

Evelyn Thompson

Evelyn is a retired waitress and a widow. She receives an average-level Social Security benefit of $16,000 per year, as well as $11,000 from her husband’s 401(k). She has $10,000 in medical expenses.

Evelyn’s tax bill will not change under the final legislation. She does not pay anything under the current tax system, and she won’t pay anything under the new system because it does not change the taxation of Social Security benefits or investment income.

Moreover, the increased standard deduction means that if Evelyn were to receive or earn more income, more of it would not be taxable.

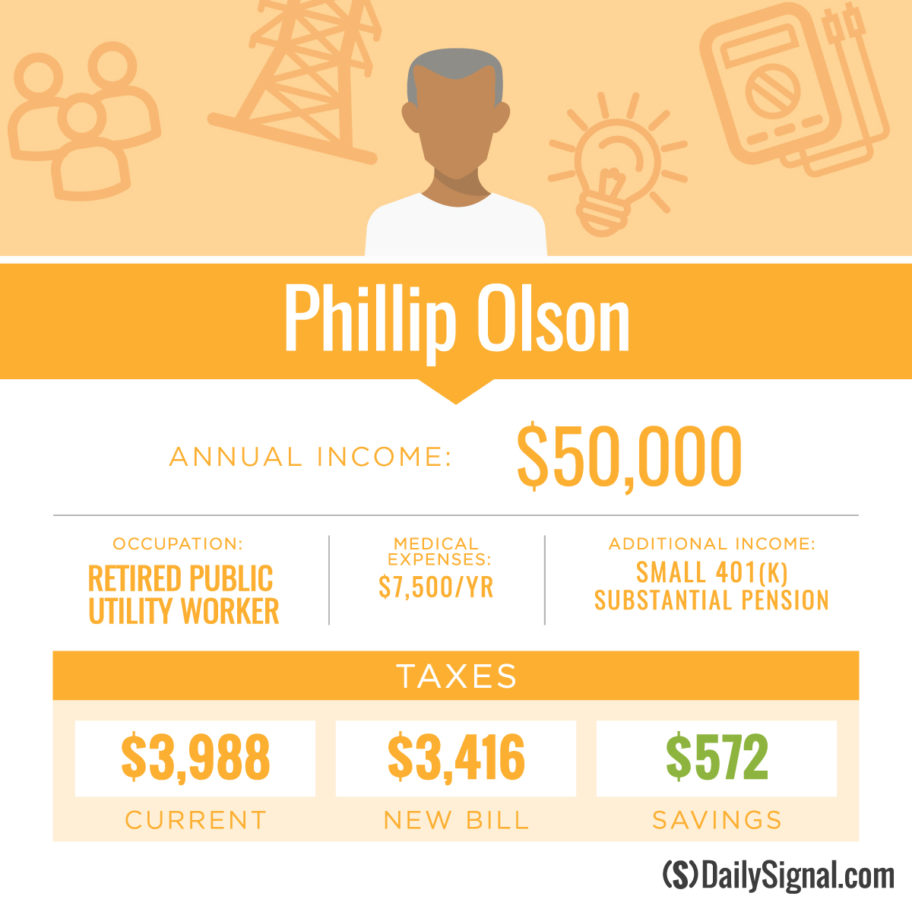

Phillip Olson

Phillip is a retired utility worker. He earned an average income throughout his career, but now receives a significant pension and even saved a little on his own through a 401(k).

His combined retirement income is $50,000 a year, consisting of $18,000 in Social Security benefits, a $28,000 pension, and $4,000 in 401(k) income. Phil has $7,500 in medical expenses, and he currently pays $3,988 in federal taxes.

Phil’s tax bill will go down by $572, or 14.4 percent, under the final tax reform legislation (to $3,416).

Phil’s tax cut is primarily the result of lower marginal tax rates on his $28,000 in pension income. In addition, no changes will be made to the taxation of Phil’s $18,000 in Social Security benefits, or his $4,000 in 401(k) income.

Although Phil has $7,500 in medical expenses, the higher standard deduction makes it not worthwhile for him to deduct these expenses, meaning he will face less paperwork and a simpler tax-filing process.

See the full story here.

December 22, 2017

Want more BFT? Leave us a voicemail on our page or follow us on Twitter @BFT_Podcast and Facebook @BluntForceTruthPodcast. We want to hear from you! There’s no better place to get the #BluntForceTruth.